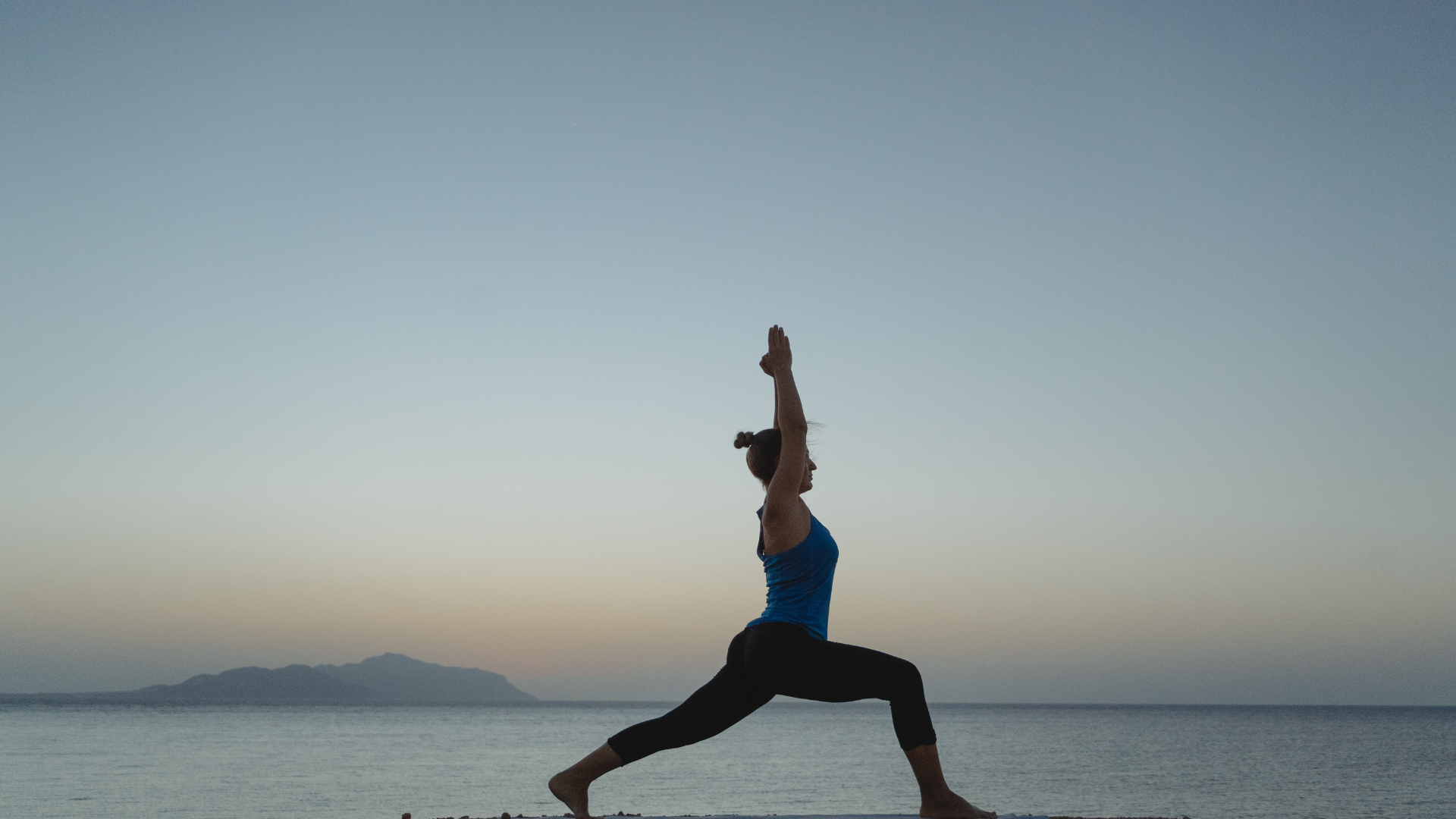

Claiming Your Financial Power

Money isn’t just about paying bills. It’s about choices, freedom, and power. The Warrior Mindset teaches us that financial independence is like preparing for battle. It requires strategy, discipline, and the courage to take action. Yet, many women hesitate, waiting for the “perfect” moment to take control of their finances.

The truth is, there is no perfect time. The time is now. At Wealth BuildHers, we believe every woman can build lasting wealth with the right mindset and tools. Let’s take the first step together.

1. Master the Basics: Knowledge Is Your Greatest Asset

Financial literacy is the foundation of long-term success.

Start by learning the basics: budgeting, investing, and saving. You don’t need a finance degree, just a willingness to learn. Listen to podcasts, read books, and follow experts who simplify financial strategies.

Remember, money is a tool. When you know how to use it, you make smarter choices, avoid costly mistakes, and set yourself up for success.

2. Make Your Money Work for You

Saving is essential, but investing is the real key to building wealth. The wealthy don’t just save. They grow their money.

Stocks, real estate, and businesses can generate passive income and build long-term wealth. Even small investments add up over time. Don’t let fear hold you back. Every successful investor started somewhere. The most important step? Starting now.

3. Build a Legacy That Lasts

Wealth isn’t just about today; it’s about securing your future and creating opportunities for generations to come.

A strong financial plan includes long-term investments, retirement savings, and estate planning. Focus on lasting impact. Your financial success doesn’t just benefit you; it empowers your family and community.

Your Wealth Journey Starts Today

The best time to start building wealth was yesterday.

The second-best time is right now.

You don’t need permission.

You just need to take action.

At Wealth BuildHers, we’re creating a community of women ready to take charge of their financial future.

One Comment

Comments are closed.