The Future of Black Wealth Is Collective Investing

In Episode 212 of the WealthBuildHERS International Podcast, I had the joy of sitting down with Dr. V. Brooks Dunbar to dive deep into a movement that’s transforming how our communities build wealth: collective investing. Not only are we redefining ownership, but we’re also reclaiming power, together.

If you’ve ever caught yourself thinking, “I don’t have enough to invest,” let me lovingly interrupt that thought. Because when we shift from me to we, everything changes.

Why Pooling Resources Just Makes Sense

For far too long, we’ve been taught that wealth is a solo journey. That you’ve got to grind it out alone, keep your money private, and somehow figure out how to “make it” on your own. But here’s the truth: wealth was never meant to be a one-person job.

Imagine this: five women each contribute $2,000. Now they have $10,000. Ten families invest $500 a month. That’s a community fund with real buying power.

And we’ve done this before. Think susu circles, church building funds, or family reunions where everyone chips in. We’ve always known how to do this. Now, we’re giving it structure, strategy, and security.

Why Now? Because Waiting Is No Longer an Option

Let’s face it. The racial wealth gap is still a gaping wound in our economy. Access to capital for Black entrepreneurs remains limited. And real estate? It’s moving further out of reach for everyday buyers.

But here’s the good news: we don’t have to wait for a seat at someone else’s table. We can build our own.

With collective investing, we can:

-

Control the direction of our neighborhoods

-

Circulate wealth within our own communities

-

Model financial literacy and ownership for the next generation

And yes, it’s about financial equity, but also social equity.

Collective Investing, in Real Life

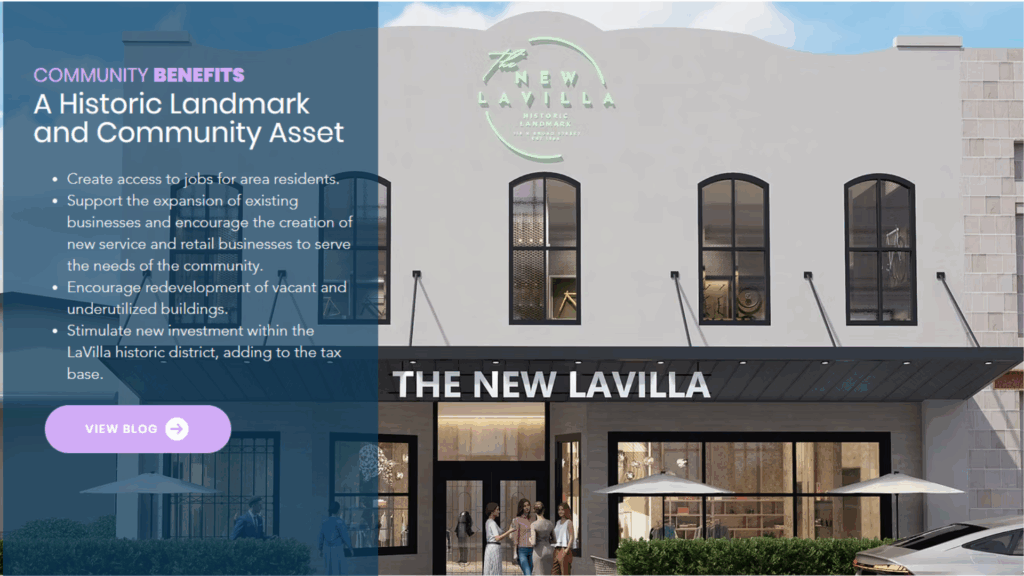

Take a look at The New LaVilla Project. Instead of depending on a few wealthy investors, this initiative brings in community members through Reg CF crowdfunding. You can invest what you have and receive equity in return.

This isn’t just real estate. We’ve seen collective investing work for:

-

Farmland

-

Startups

-

Small businesses

-

Community centers

If it adds value, we can invest in it together.

But Wait, Let’s Talk About the Fears

Maybe you’ve heard things like:

-

“It’s too complicated.”

-

“I’ll lose control.”

-

“We’ll never agree.”

Let’s rewrite those myths. With clear communication, shared goals, and a little legal guidance, these investments become not only manageable but empowering.

The key ingredients? Trust. Education. A bold shift from fear to action.

Ready to Start Your Investment Circle?

Don’t overthink it. Start small, start now.

Here’s a simple roadmap:

-

Find your tribe. Gather 3–5 like-minded folks.

-

Set clear goals. Is it for real estate, business, or community development?

-

Seek legal advice. Consider forming an LLC or partnership.

-

Put tools in place. Try HoneyBook, Asana, or a shared bank account.

-

Stay curious. Keep learning, attending webinars, and reading up.

And remember: WealthBuildHERS International is here to guide you every step of the way.

LIVE Framework in Action

Let’s break it down:

-

Learn what collective investing is and how it works.

-

Invest with intention, not just dollars.

-

Value community over competition.

-

Enjoy the fruits of ownership with others.

Final Takeaways:

-

Collective investing unlocks ownership for those often left out.

-

It strengthens our communities, financially and emotionally.

-

It’s not about having more. It’s about doing more with what we have.

We’re not just buying buildings. We’re building a movement. Confidence. Competence. Collective wealth.