Did you know it was once illegal for women to open a bank account without a man? That was just 50 years ago. Yet today, women are leading Fortune 500 companies and controlling trillions in assets. How did we get here?

In a recent episode of the Wealth BuildHers podcast, “Women’s Financial History: The Ongoing Journey of Women’s Wealth”, we explored the key moments that have shaped women’s financial history. In this post, we take that conversation a step further, tracing the powerful milestones from land ownership to leadership at the Federal Reserve. Each moment in this journey highlights how far we’ve come and how much further we can go, together.

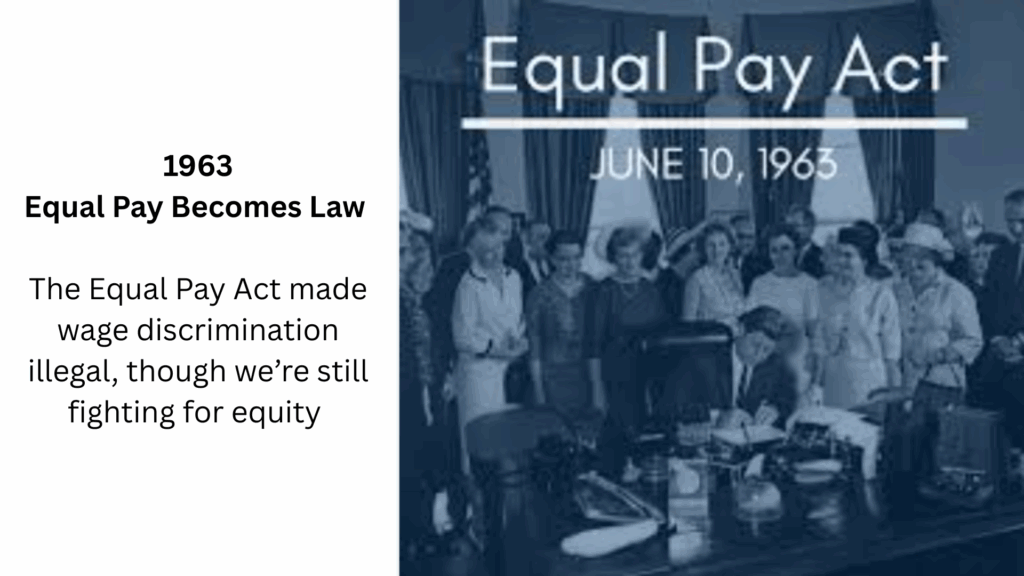

A Timeline of Power Moves

1920 – “The Woman Investor” is Published: Clara Porter urged that women be seen as serious investors, not just savers. She was way ahead of her time.

1974 – Credit Without Permission: At last, women could open credit cards and bank accounts in their own name. This law unlocked countless financial doors.

1993 – Maternity Leave Becomes Protected: The Family and Medical Leave Act ensured job security during family or medical leave. It marked a key shift in workplace rights.

Why This History Still Matters

These wins didn’t come easily, and they’re still not enough. Too many women remain stuck in jobs or relationships because they can’t afford to leave. True wealth is about freedom: freedom to choose, to grow, to walk away, or to lean in.

That’s why I created WealthBuildHers—to equip women with the tools, education, and support to build resilient, mission-driven wealth.

Let’s Talk Strategy – Book a clarity call and start designing a life that feels like freedom.

Get On the List – Receive weekly insights, wealth tips, and real stories from women rewriting the rules. Join Here

Subscribe on YouTube – Don’t miss powerful conversations and fresh episodes designed to fuel your journey. Hit subscribe here.

Want More Support on This Journey?

I created the 7 Steps to Resilient Wealth course to help you build wealth from the inside out. While the full course is still in development, you can get early access to foundational materials now and join the waitlist to be the first to know when the full version launches.

Bonus: The first 10 people to download the workbook will also receive free access to the full course when it’s released!

👉 Join the waitlist + get the workbook now

Ready to write your chapter in women’s wealth history?

⬇️Drop it in the comments. We’d love to feature you!

Because your story fuels the movement,

And your voice has the power to inspire change.