[vc_row][vc_column][vc_column_text]Back in March, we all probably thought the pandemic would be over by now. It looks like it will be around a lot longer, and our political landscape is… I have no words. Our landscape is pretty confusing. I heard President Trump say that the economy is great. He followed that by saying the stock market is great. I took that to mean that he was measuring the health of the economy by the apparent health of the stock market…

Is that how we judge how well the economy is doing?

Here are 7 indicators of a strong economy according to an article from Fairmont Equities.

- Strong Employment Numbers

- Stable Inflation

- Interest Rates are Rising

- Wage Growth

- High Retail Sales

- Increasing New Home Sales

- Increasing Industrial Production

Let’s take a look at each of these and see if we agree that an increasing stock market correlates with a good economy.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

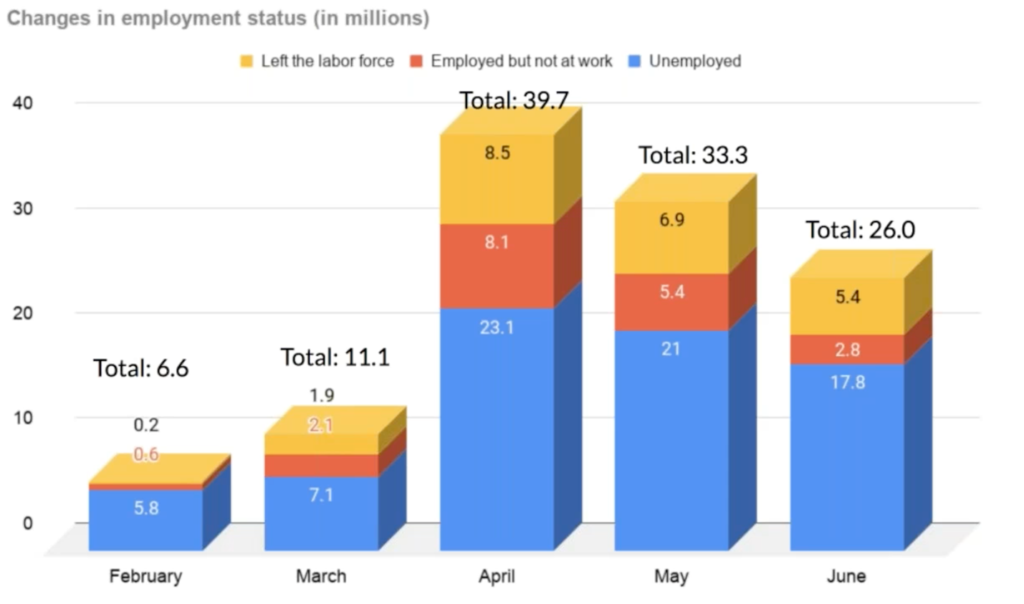

1. Strong Employment Numbers

Since February, there have been 19 million people added to the unemployment rolls. The current unemployment rate is just over 11% compared to 3.8% in February 2020.

Source: Access Insiders

2. Stable Inflation

For the first six months of 2020, the average inflation rate was 1.2%. For the past 3 months that rate has been below 1%. We have actually deflationary. Prices have been falling. Sounds great! Why prices are falling is the problem. Prices are falling because there is less buying. Why is there less buying, see indicator number one.

3. Interest rates are Rising

The U.S. central bank announced Wednesday that it would leave its benchmark federal funds rate in the current target range of 0-0.25 percent.

Source: Bankrate.com

4. Wage Growth

According to the US Bureau of Labor statistics, real average hourly earnings for all private non-farm employees increased 4.3 percent from June 2019 to June 2020. The increase in real average hourly earnings combined with a 0.3-percent increase in the average workweek resulted in a 4.6-percent increase in real average weekly earnings over the year.

The increases in real average hourly and weekly earnings largely reflect the substantial job loss over the year among lower-paid workers as a result of the COVID-19 pandemic and the efforts to contain it.

5. High Retail Sales

Trading Economics.com states that retail sales in the US surged 7.5% month-over-month in June of 2020, following an upwardly revised record 18.2% rise in May. Figures beat market forecasts of a 5% gain as more businesses reopened and domestic trade continues to recover from a slump in April due to the coronavirus lockdown.

The biggest increases were seen in sales at clothing stores (105.1%); electronics and appliances (37.4%); and furniture (32.5%).

6. Increasing New Home Sales

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced the following new residential sales statistics for June 2020.

Sales of new single-family houses in June 2020 were at a seasonally adjusted annual rate of 776,000, this is 13.8 percent (±17.8 percent)* above the revised May rate of 682,000 and is 6.9 percent (±13.7 percent)* above the June 2019 estimate of 726,000.

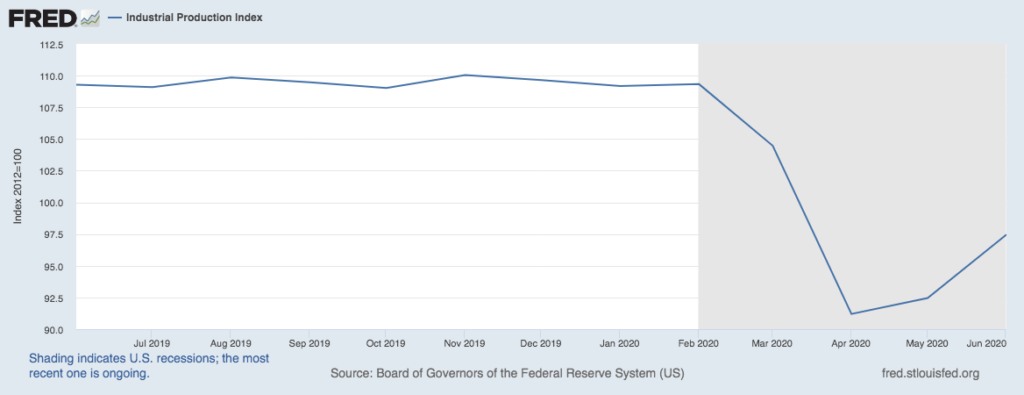

7. Increasing Industrial Production

Industrial production refers to the output of industrial establishments and covers sectors such as mining, manufacturing, electricity, gas and steam and air-conditioning. A picture is worth a thousand words…

In summary, year over year employment is down, inflation is relatively stable, interest rates are very low and are NOT rising. Wage growth, it depends on where your wages come from, higher wage earners have seen an increase year over year, lower-wage earners have not.

Retail sales are high now, but that’s because they fell off a cliff in April, also note that sales fell by over ½ in June after the rebound in May.

Industrial production is also increasing, again because of the sharp decrease in March, but we are nowhere near our pre-pandemic levels of production.

The stock market is up since the first of April, but we are still working our way back to pre-coronavirus levels. The reason, many economists believe that the stock market is up is due to manipulation and not market fundamentals such as supply and demand.

For now, we have to decide for ourselves by looking at the factors that determine a good economy. Our personal economies and the national or global economy whether we are in good shape or bad shape. I know what it feels like to me. Now more than ever I want my money to have a mission. I want it out working hard for me while it is improving the lives of others.

There are REAL opportunities available where you can make a difference. Start this discovery by telling us more about you here>> and we’ll get you connected to projects of your interest.

For the latest updates on COVID-19, visit www.cdc.gov[/vc_column_text][/vc_column][/vc_row]