When was the last time you did something for the first time?

That’s the question that is asked on the cover of Seth Godin’s book, Poke The Box, a manifesto to push you to start something new. He points out, if you don’t start, you cannot fail. Fear of failure why so many do not start.

not start.

We are taught, in school, that failure is not acceptable. We are punished for trying a new way to solve a math problem. For those of you with children in elementary school, learning math these days is a whole new experience. I am happy that 5-year-old Piper can teach me how to do addition the way she has been taught to do it. I personally liked the count on my fingers until I had it memorized.

Children are not afraid to try something new. Everything seems like an adventure to them. Walking, riding a bike, climbing a tree, even going to school for the first time. Adults can make them afraid to do something, mainly because we fear their failure and want to protect them from pain.

It has been shown that the way to learn is to fail. When we are successful on a first try, what have we learned? We believe that we got it right because we are smart or the problem was easy. When we fail, if we are smart, we evaluate what happened and learn a better way to try the next time.

As adults we stay within our comfort zones, never leaving our jobs, houses, or hometowns. We stay even if doing so makes us unhappy and uncomfortable. Some would rather hope and wish for better circumstances than to take action.

Investing money is one such circumstance. Losing money annoys me, and at times scares me. Even today as a real estate investor and syndicator, I am afraid of losing money. Are you afraid to lose money? The majority of us are.

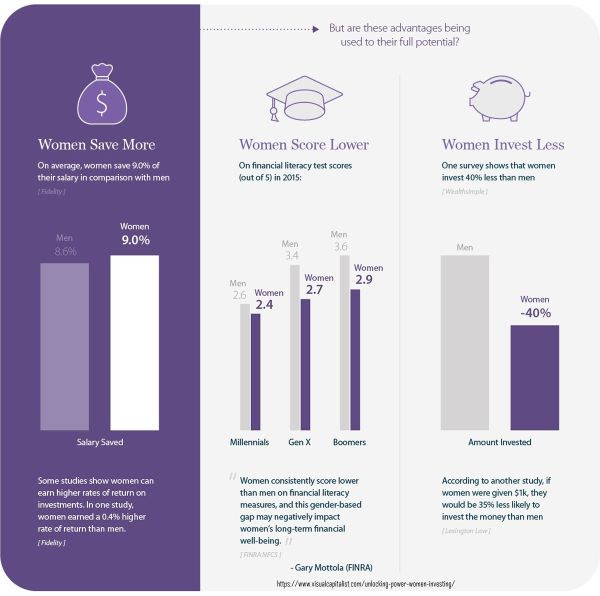

Statistics say that women are much less likely to invest money, but are more likely to save. Likely because it feels less risky. Let’s take a look at that.

In our current environment, if you have your money in a regular savings account, you are earning on average 0.199% in interest. The high in the U.S. is 1.3%. The current inflation rate for the 12 month period ended 4/2020 is 0.3%.

This is a bit misleading, the inflation rate for March was 1.5% and the average for 2019, 1.8%. But, even at 0.3% inflation and an average interest rate on your savings, you are losing. And the risk is that the inflation rate will increase which will cause you to lose faster. It took me a bit to understand this.

Here’s a scenario to help you understand, let’s say you have $20,000 saved in an interest saving account with a rate of 0.199% and inflation is 0.3%. In a year, you would like to purchase a new car that is currently $21,000. When it’s time to purchase, your interest savings account has grown to $20,039.80 but inflation has also increased and your new car now costs $21,063. As you can see the amount you have saved is not going to get you that car.

Now, the difference in the car scenario is small but what if interest rates stay the same as inflation continues to increase? You will continue to lose money and the bank will continue to make money using yours.

Here’s how the bank uses your money… while your $20,000 is sitting in the bank, they are loaning your money to someone who is willing to pay higher interest than 0.199%. If they were loaning it out for 3% interest the same year you were “saving” they would have made a gross profit of $600. Compare that to your $39.80 gross profit on the same amount of money. This is just the estimate, legally they can loan your money to several people at the same time.

You are risking your financial future by “playing it safe” and letting your hard-earned money sit around in the bank. It is not sitting, the bank is using it to make more money for itself.

We want the next generation to be better. We want to leave them a financial legacy in addition to the values that we hold dear. For that to happen, we must become financially literate, learn to make money work for you. Once that is accomplished, neither you nor your children will NEED to work for money, you will send those dollars out to work for you. Learn to minimize your fear and embrace the risks of investing, the positive ripple effects will be enormously felt in the future.